Yen weakens as BOJ offers few rate clues; investors indecisive after Trump-Xi deal

While most investors viewed the Trump-Jinping meeting as positive, many remained cautious on how long the thaw in icy trade relations would last.

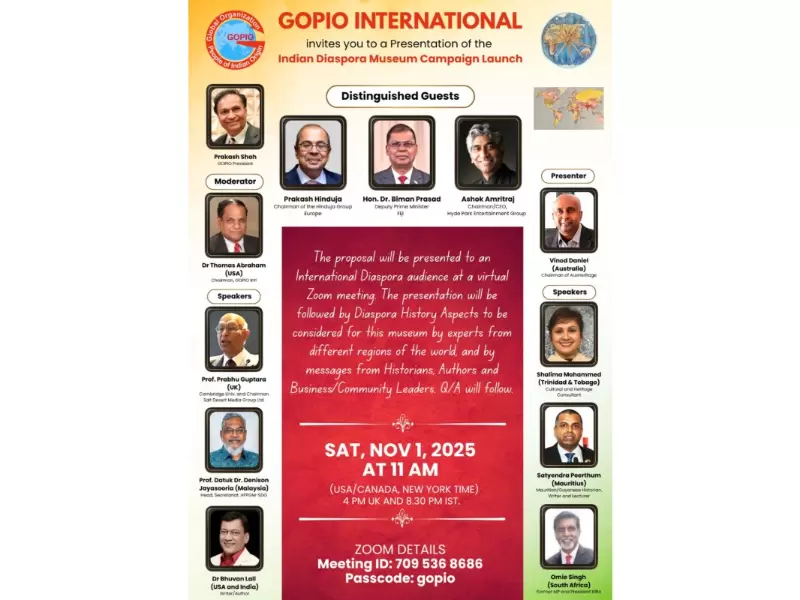

U.S. dollar, Euro, Yen and Pound banknotes are seen in this illustration taken May 4, 2025. / REUTERS/Dado Ruvic/Illustration

U.S. dollar, Euro, Yen and Pound banknotes are seen in this illustration taken May 4, 2025. / REUTERS/Dado Ruvic/Illustration

The yen fell on Oct. 30 after the Bank of Japan (BOJ) left rates unchanged, while other currencies held in tight ranges as investors weighed a trade agreement between U.S. President Donald Trump and Chinese President Xi Jinping.

Trump said he had agreed to trim tariffs on China in exchange for Beijing resuming U.S. soybean purchases, keeping rare earths exports flowing and cracking down on the illicit trade of fentanyl. But details were scant and China has offered little clarity.

The BOJ maintained its policy rate at 0.5 percent as expected at the conclusion of its two-day monetary policy meeting, but repeated its pledge to continue increasing borrowing costs if the economy moves in line with its projections.

Still, investors saw the decision as a cautious one from the BOJ, with only two policymakers again calling for a hike - the same as in September - underscoring the central bank's gradual pace in normalising policy.

At a post-meeting press conference, BOJ Governor Kazuo Ueda also offered little detail on when the central bank could next raise rates.

That heaped pressure on the yen, which slid to an 8-1/2-month low of 153.52 per dollar as Ueda spoke.

The Japanese currency similarly fell to an all-time low against the euro at 178.39, while sterling was up 0.5 percent at 202.45 yen.

"The market wasn't expecting a hike anyway, but I think the market was kind of disappointed that the number of dissenters remained at two," said Sim Moh Siong, a currency strategist at Bank of Singapore.

"There's a contrast here between a Bank of Japan that's still cautious in terms of rate hikes, and a (Federal Reserve) that's cautious in terms of rate cuts."

Trump-Xi meet and Fed's hawkish surprise

In the broader market, stocks were choppy while currencies and bonds were largely muted as details slowly emerged from the Trump-Xi meeting in South Korea. In recent days, Trump had repeatedly talked up the prospect of reaching an agreement with Xi to de-escalate tensions.

While most investors viewed the outcome as positive, many remained cautious on how long the thaw in icy trade relations would last. Previous trade negotiations have seen promising starts followed by setbacks.

ALSO READ: Trump shaves China tariffs after 'amazing' Xi meeting

"The bottom line is that China and the U.S. are probably the most important strategic competitors of each other in the global context. So you cannot expect the kind of trade agreement we saw during the globalisation era ... any agreement will be unstable in nature, both sides could change," said Vincent Chan, China strategist at Aletheia Capital.

The dollar gave up some of its overnight gains, though remained not far from a two-week high against a basket of currencies at 99.10.

The euro was up 0.16 percent at $1.1620, having weakened 0.43 percent in the previous session. Sterling languished near Oct. 29's 5-1/2-month low and last bought $1.3208.

The greenback got a lift on Oct. 29 after hawkish comments from Federal Reserve Chair Jerome Powell, who said a policy divide within the central bank and a lack of data due to a federal government shutdown may put another rate cut out of reach this year.

The Fed lowered rates by 25 basis points as expected and said it will end its balance sheet drawdown on Dec.1.

"Clearly, the FOMC is divided on the policy outlook from here and with the government in shutdown still, I think Powell wants to approach policy more cautiously," said Carol Kong, a currency strategist at Commonwealth Bank of Australia.

"We still expect a cut in December, but obviously with Powell's cautious comments, the risk is that a rate cut is delayed to 2026."

The market odds of the Fed delivering another quarter-point cut in December have eased to around 68 percent, having been nearly fully priced before Oct. 29's decision.

Elsewhere, the Australian dollar rose 0.11 percent to $0.6582, while the New Zealand dollar gained 0.17 percent to $0.5774.

ADVERTISEMENT

ADVERTISEMENT

E Paper

Video

Reuters

Reuters

Comments

Start the conversation

Become a member of New India Abroad to start commenting.

Sign Up Now

Already have an account? Login