Jayapal rejects GOP bill on stock trading as “inadequate”

The Democrat called the GOP proposal inadequate while backing the full divestment bill.

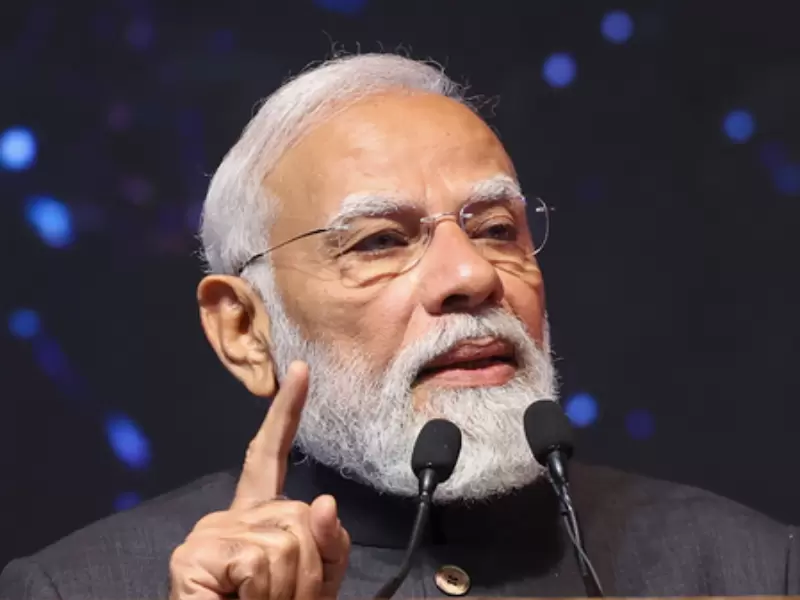

Rep. Pramila Jayapal / Courtesy: X/@RepJayapal

Rep. Pramila Jayapal / Courtesy: X/@RepJayapal

Rep. Pramila Jayapal on Jan. 12 criticized a House Republican-backed bill on congressional stock trading, calling it inadequate and urging lawmakers to advance a stronger bipartisan alternative.

In a post on X, Jayapal said the Republican proposal “falls far short of what the American people want and deserve,” arguing that the House should instead move the Restore Trust in Congress Act, which she described as a bipartisan consensus measure.

ALSO READ: "Americans must stand with Powell": Rep. Khanna slams DoJ probe

House Republicans’ new legislation on Congressional stock trading falls far short of what the American people want and deserve. The House must move forward on our bipartisan consensus bill, the Restore Trust in Congress Act.

— Rep. Pramila Jayapal (@RepJayapal) January 12, 2026

My full statement with @Rep_Magaziner and @RepAOC: pic.twitter.com/kXoRatHNpD

The Republican bill, introduced as the Stop Insider Trading Act by House Administration Committee Chairman Bryan Steil, would bar members of Congress, their spouses, and dependent children from buying new publicly traded stocks while maintaining ownership of the ones they already own.

In a joint statement with Reps. Seth Magaziner and Alexandria Ocasio-Cortez, Jayapal said allowing continued ownership of stocks leaves room for conflicts of interest.

The Restore Trust in Congress Act, backed by Jayapal, would require lawmakers, their spouses, and dependent children to divest individual stocks and prohibit future ownership or trading. It sets divestment deadlines ranging from 90 to 180 days, depending on circumstances, and outlines enforcement provisions.

In their joint statement, the lawmakers said, “We hope that Speaker Mike Johnson will find the courage to move the Restore Trust in Congress Act, a bipartisan consensus bill that has wide support from members of both parties and will end the practice of Members of Congress owning and trading stocks once and for all.”

The debate comes amid ongoing concerns over public trust in Congress, fueled by reports that some lawmakers’ investment returns have exceeded market averages. Public opinion polls have consistently shown strong backing, often above 80 percent, for restrictions or bans on congressional stock trading.

Discover more at New India Abroad.

ADVERTISEMENT

ADVERTISEMENT

E Paper

Video

1759163132.png) Anushka Pathak

Anushka Pathak

Comments

Start the conversation

Become a member of New India Abroad to start commenting.

Sign Up Now

Already have an account? Login