US tech shares hold steady after Trump unveils $100,000 H-1B visa fee

Investors weighed the impact of higher visa costs on tech hiring, with analysts warning of longer-term pressure on wages and margins.

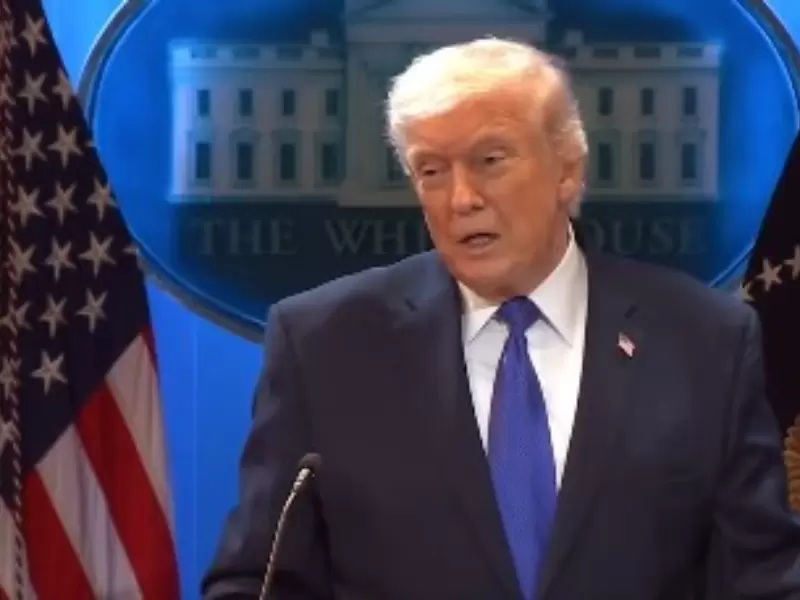

Representative Image / iStock

Representative Image / iStock

U.S. tech shares were little changed on Sept 22 after President Donald Trump announced a $100,000 one-time fee for H-1B visas, part of his immigration crackdown that has raised concerns about higher labor costs and limited access to skilled workers.

The H-1B program allows U.S. employers to hire foreign workers in specialty fields such as technology and engineering, and higher fees threaten to raise labor costs for tech companies that depend heavily on this talent pipeline.

Over 70 percent of these visas went to Indian nationals last year, U.S. data showed. During Trump's first term, the administration tightened visa approvals and raised scrutiny of applications, moves that drew lawsuits from industry groups.

Analysts said the impact should be moderate, given that the fees apply only to new applications, but warned that a constrained supply of skilled workers in the U.S. may push wages higher and squeeze margins.

Amazon, Google parent Alphabet, Meta, and Microsoft are consistently among the top corporate sponsors of H-1B visas, data shows, underscoring their dependence on foreign engineers and developers to fuel growth in areas such as cloud computing and artificial intelligence.

Shares of Cognizant Technology Solutions, JP Morgan, and Intel, which rank among the biggest sponsors of H-1B visas, were trading between down 1.7 percent and up 1.9 percent.

"The H1B fee will constrain talent supply in the U.S., which in turn will drive up demand for locals or green card holders. IT firms will have to pay these employees more or risk losing them," Jefferies analysts said in a note.

"The talent supply crunch will drive up on-site wages, which could drag profits by 4-13 percent."

Industry lobby groups, including India's Nasscom and the U.S. Chamber of Commerce, are expected to push back, arguing the fees will hurt innovation and discourage global talent from seeking jobs in the United States, analysts said.

Also Read: US H-1B visa clarification eases uncertainty, India's IT industry body says

Indian IT stocks hit

Indian IT workers make up the bulk of H-1B applicants, and while Indian IT companies have long benefited from U.S. work visa programs, they now face the prospect of higher costs and slower revenue growth.

Indian IT stocks slid on Sept 22, with the tech sub-index dropping nearly 3 percent and dragging the broader Nifty 50 index down.

U.S.-listed shares of Infosys and Wipro were up 1 percent and down 0.5 percent, respectively.

"We believe this will essentially shut out new H-1B visas except in extreme cases for Indian IT companies, as the $100,000 increment is nearly double their median salaries and doesn't make economic sense," Ambit Capital analysts said.

ADVERTISEMENT

ADVERTISEMENT

E Paper

Video

Reuters

Reuters

Comments

Start the conversation

Become a member of New India Abroad to start commenting.

Sign Up Now

Already have an account? Login